who claims child on taxes with 50/50 custody

Stimulus Checks- Joint 5050 Custody- Claiming Child Alternate Tax Years The situation. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

How Do You Claim A Child On Taxes With 50 50 Custody

How Alabama Courts Make Child Custody Decisions.

. Taxes simply reflect finances not living situations. A child must live with the parent for 50 percent of the year or more to be claimed as a dependent. Think of it this way.

Based upon what you have written about unless there is a court order addressing the question that you have written about as to which parent gets to claim the minor child as a. The Ventura family law attorneys at the Law Offices of Bamieh and De Smeth can help you negotiate and argue your child custody case taking into account the tax. But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it.

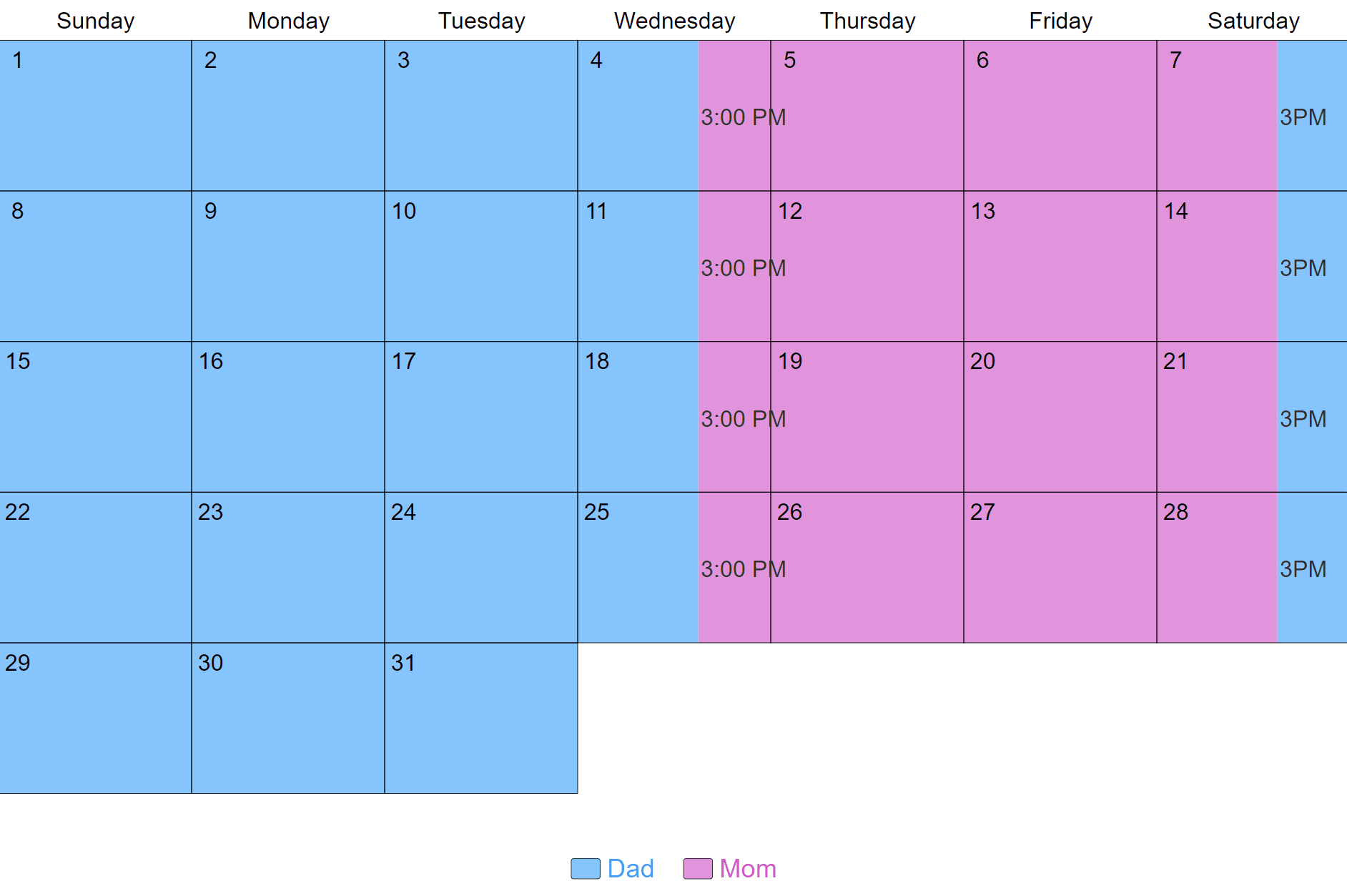

Mom and Dad share joint 5050 custody and claim the child on alternate tax years. Usually this amount can be claimed by either parent. Who Claims a Child on.

The amount for Childs Fitness and Arts. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. So one parent claims for the child.

Who Claims Your Child on Taxes if You Have 50-50 Custody. However most parents state that they have joint custody or. When there is no signed document by the custodial parent then the IRS recognizes the custodial parents claim to dependency.

The noncustodial parent can claim the child on taxes if the custodial parent signs a Release of Claim to Exemption. So if both parents share parenting time but one pays more for their expenses than the other. Who Claims the Child if Both Parents Have Custody But One Pays More for the Childs Needs.

Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. If one parent is paying for the costs of the child and another parent is raising the child the one who is. The IRS rules are in place to make tax filing for parents with 5050 custody as fair as possible.

Understand the common factors Alabamas judges use when making child custody decisions. The noncustodial parent would attach this to their tax return and submit. That means that if the children live with one parent for most of the time that.

In some cases divorced or unmarried couples. Typically when parents share 5050 custody they alternate. Often in the case of 5050 custody and similar financial contribution from the parents the court orders that the parents take turns in claiming for the child.

Parents Can Decide Who Will Claim a Child on Tax Returns. In most scenarios the parent with the highest adjusted gross income is entitled to claiming any tax credits or deductions afforded. In the joint custody case both parents have the right to claim this amount.

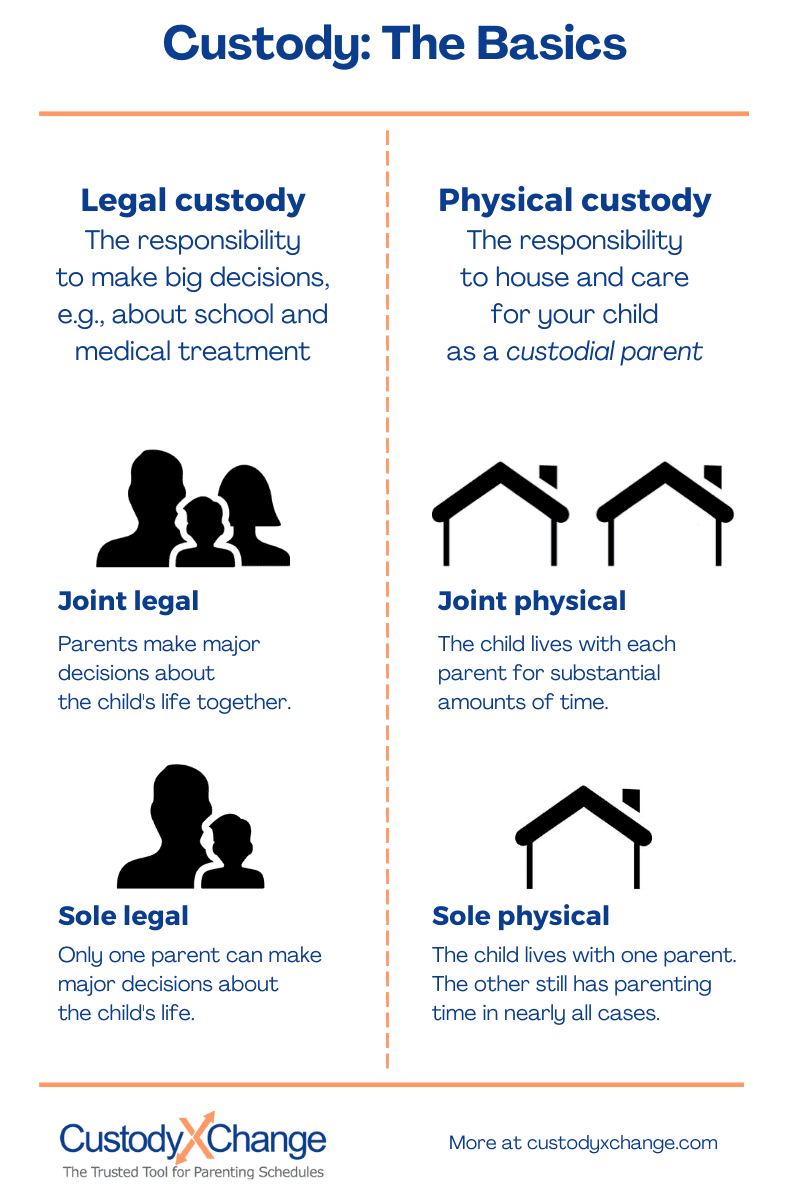

Joint Legal Custody Defined Advantages Disadvantages

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

/shutterstock_132049541-e0ba47340e9649fe8c267ee5fea6326a.jpg)

9 Rules To Make Joint Child Custody Work

Do I Have To Pay Child Support If I Share 50 50 Custody Lawrina

4 3 Custody Visitation Schedules How Does It Work Pros Cons

Who Claims A Child On Us Taxes With 50 50 Custody

50 50 Joint Custody Schedules Sterling Law Offices S C

New Child Tax Credit 2021 For Parents Who Share Custody

50 50 Custody Child Support Calculator Family Lawyer Winnipeg

How Do You Claim A Child On Taxes With 50 50 Custody

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

What Does A 50 50 Or Joint Custody Agreement Look Like

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

How Do You Claim A Child On Taxes With 50 50 Custody

Child Joint Custody Agreement Template Custody Agreement Separation Agreement Template Separation Agreement

Do I Have To Pay Child Support If I Share 50 50 Custody

Do I Have To Pay Child Support If I Share 50 50 Custody

What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos